-

Mortgage TIPS

1) Get independent advice on your financial options.

As independent mortgage brokers and mortgage agents, we’re not tied to any one lender or range of products. Our goal is to help you successfully finance your home or property. We’ll start by getting to know you and your homeownership goals. We’ll make a recommendation, drawing from available mortgage products that match your needs, and we will decide together on what’s right for you.2) Save time with one-stop shopping.

It could take weeks for you to organize appointments with competing mortgage lenders — and we know you’d probably rather spend your time house-hunting! We work directly with dozens of lenders, and can quickly narrow down a list of those that suit you best. It makes comparison shopping fast, easy, and convenient.3) We negotiate on your behalf.

Brokers negotiate mortgages each and every day on behalf of Canadian homebuyers. You can count on our market knowledge to secure competitive rates and terms that benefit you.4) More choice means more competitive rates.

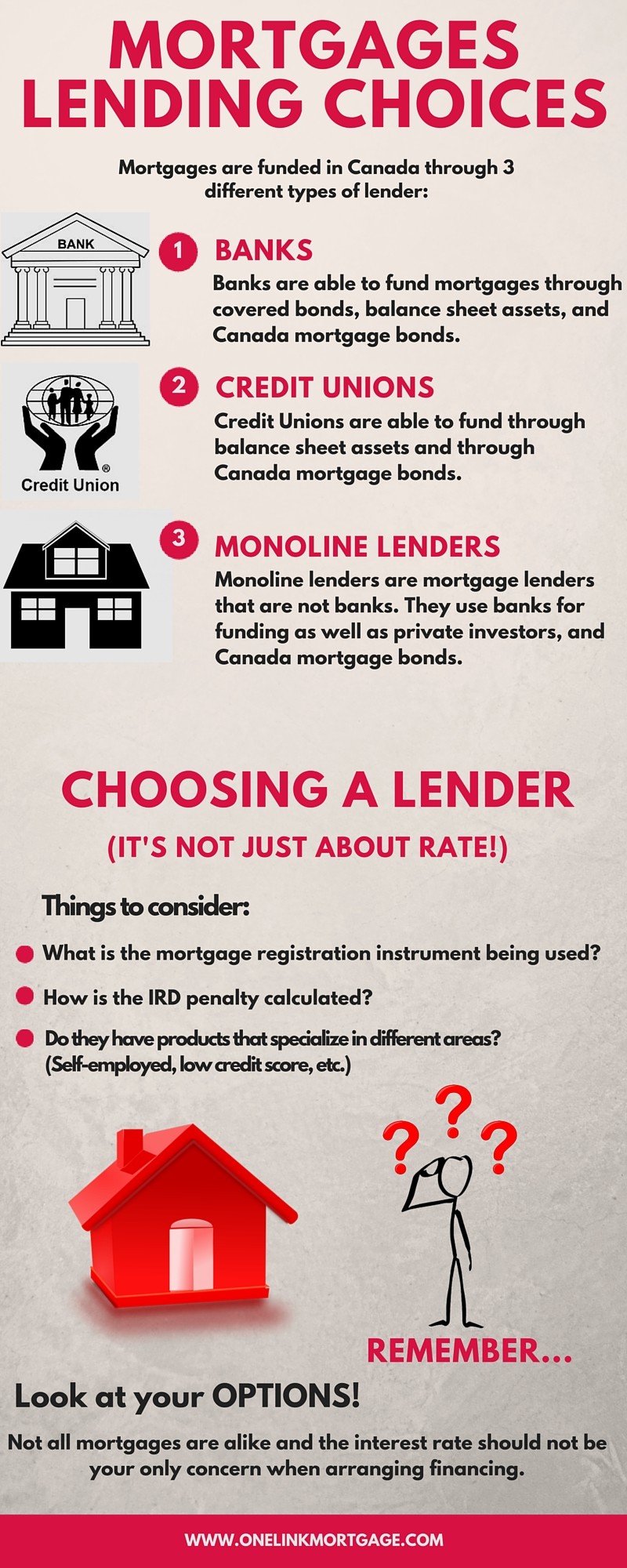

We have access to a network of major lenders in Canada, so your options are extensive. In addition to traditional lenders, we also know what’s being offered by credit unions, trust companies, mono-line lenders, and other sources.5) Ensure that you’re getting the best rates and terms.

Even if you’ve already been pre-approved for a mortgage by your bank or another financial institution, you’re not obliged to stop shopping! Let us investigate to see if there is an alternative to better suit your needs.6) Get access to special deals.

Many financial institutions would love to have you as a client, which is why they often offer incentives to attract creditworthy customers, like discounted rates.7) Things move quickly!

Our job isn’t done until your closing date goes smoothly. We’ll help ensure your mortgage transaction takes place on time and to your satisfaction.8) Get expert advice.

When it comes to mortgages, rates, and the housing market, we’ll speak to you in plain language. We can explain the various mortgage terms and conditions so you can choose confidently.9) No cost to you.

There’s absolutely no charge for our services on typical residential mortgage transactions when purchasing a property. How can we afford to do that? Like many other professional services, such as insurance, mortgage brokers are generally paid a finder’s fee when we introduce trustworthy, dependable customers to a financial institution. These fees are quite standard and nearly industry-wide so that the focus remains on you, the customer.10) Ongoing support and consultation.

Even once your mortgage is signed and paperwork is complete, we are here if you need any advice on closing details or even future referral needs. We are happy to be of assistance when you need it.• How much down payment do I need?

• What is CMHC Insurance and why is it required?

• What’s the difference between an open and closed mortgage?

• What’s the difference between a variable rate and fixed rate mortgage?

• What are the penalties if I were to sell or payout the mortgage mid term?

• What is Collateral Charge vs a Standard Charge Term?

• Can I make prepayments without being penalized?

• When will my first payment be?

• Your most recent pay stub if you are salaried. (Different criteria is required depending on how you are compensated.)

• A letter from your employer confirming how long you’ve worked there and your rate of pay.

• If you are self employed, the last 2 years T1 General Tax Returns and 2 years Notice of Assessments.

• A 3 month bank transaction history to show you have accumulated the amount of money necessary to make up the down payment, closing costs and legal fees.

• Other documentation may be requested

1) Determine how much you can afford.

Based on your down payment, income, existing debt, regular expenditures, and other key financial information, we can help you determine how much you can afford to pay every month and the price range that works within your budget.2) Team up with a real estate agent.

Finding a real estate agent to help you search for your dream home is important to the home buying process. The best real estate agent will be a combination of a personal advisor, consultant, and negotiator. This expert will show you homes that match your criteria, guide you through the home buying process, and negotiate the best possible price for your home.3) Make an offer.

When you’ve found a place that you’d like to call your own, your real estate agent will help you draw up an Offer to Purchase to present to the seller. This legal document specifies the price, the closing date, and any conditions.4) Retain a lawyer.

It’s important to hire a lawyer who specializes in real estate. You could find yourself in a bidding war for the home you want, and you may want a lawyer to look over any offer to purchase before you submit.5) Arrange the home inspection.

Many buyers consider including a home inspection as one of the conditions on their Offer to Purchase. A professional inspection is a good way to uncover major problems with the home. If the home doesn’t pass the inspection, you can adjust or withdraw your conditional offer.6) Get the mortgage approved.

With a copy of the signed Offer to Purchase and the necessary financial information, we’ll submit your application to the mortgage lender that we have selected. The lender will qualify the application and complete a valuation on the property you have purchased. Mortgage insurance gives you the ability to buy a home with a down payment of less than 20% of the purchase price.7) Get property insurance.

Apart from the mortgage, you’ll need to purchase property insurance that protects your home against fire and other damages. Once you have a policy in place, forward a copy to your lawyer and your lender.8) Check the legal details.

With the deal finalized and the financing in place, your lawyer can now search the title and check whether there are any unpaid property taxes outstanding. Your lawyer will arrange for a survey to be completed, if necessary.9) Complete the paperwork.

A few days before the deal is set to close, you’ll meet with your lawyer to review, sign, and get copies of all the documentation. At this time, you’ll also provide the remainder of your down payment and pay legal fees and any additional costs, such as prepaid utility expenses for which the seller should be reimbursed, that are due on closing.10) Pick up the keys.

On the closing day, your lawyer and the seller’s lawyer will exchange documents and cheques. Your lawyer will also register your new home in your name. When these tasks are complete, you’ll get the deed and your keys to your new home, and you can move in.1) Land transfer tax.

When a home changes hands, many provinces and a few municipalities charge a property transfer tax or title transfer fee. Rates are usually on a scale of 0.5% to 2% of the home’s value and can add thousands to your purchase price. First-time homebuyers qualify for rebates or exemptions in some provinces.2) Appraisal fee.

Your lender may ask you to have a home appraised to confirm its market value. Fees vary depending on a property’s value and complexity, but are typically around $400.3) Legal fees.

A lawyer or notary will help protect your interests by reviewing your purchase agreement, searching the property title, and ensuring that all documents are completed properly. Basic legal fees start between $500 and $800, plus disbursements, with added services as needed.4) Home inspection.

An inspection can help make you aware of issues related to a house’s structure and systems, such as plumbing and electrical, and recommended or necessary repairs. Fees range from about $350 to $450.5) Home/fire insurance.

Your lender will require proof that the property is insured in case of fire and other damage. Insurance costs vary, depending on the coverage needed, but budget for at least $500 a year.6) Costs for newly constructed homes.

If you’re buying a brand-new home, be prepared to settle any items not quoted in the original price, including upgrades or paving and landscaping fees. New homes are also subject to 5% GST or 13% HST, although this is often included in your purchase price. A federal rebate reduces the GST or the federal part of the HST to about 3.5% for homes valued at $350,000 or less.7) Prepaid costs.

If the seller has paid property taxes, water bills, or utilities in advance, you’ll need to reimburse these at closing. This can add hundreds to your upfront costs, but means these bills will be paid for your first months in your new home.8) Tax on mortgage insurance.

If you have less than a 20% down payment, your lender will require that you obtain mortgage default insurance. You can roll the cost into your mortgage payments, but the PST is due at closing. For example, if your mortgage insurance is $5,000 and the PST is 8%, you’ll pay $400.9) Title insurance.

Title insurance can safeguard you against fraud and problems with your property10) Moving-in costs.

Before the big day, budget for all those last minute things: $100 or more to rent a van or a few hundred for professional movers, $50 to $60 for a locksmith to rekey your locks, and cleaning supplies. Such incidentals can easily come to $500 or more. Get a tax break Under the federal First-Time Home Buyers’ Tax Credit, you can receive up to $750 in tax relief to offset your closing costs.1) Property tax.

Many of the services you’ll enjoy in your new neighbourhood, from parks and recreation facilities to road maintenance and schools, are funded in part by municipal property taxes. Rates vary widely, from region to region and home to home. Annual taxes can top several thousand dollars in urban centres, so some homeowners opt to pay in installments — your lender may provide an option to combine these with your mortgage payments.2) Energy costs.

If you’re used to keeping the lights on and the thermostat up because utilities are included in your rent, you’ll now have to pay for these costs. Budget to cover monthly gas, electric, or oil bills, which fluctuate with the seasons. Your real estate agent can ask a home’s seller to confirm past costs.3) Phone, cable, and Internet services.

The costs of being “connected” can easily add up to a couple of hundred dollars a month. Moving into a new home might be a good time to consider whether you need both a land line and a wireless line, for instance, or if you can bundle services for a discount.4) Home insurance.

Protect your home, its contents, and your property against damage or liability. Prices can vary, depending on your home and neighbourhood, but plan for costs that typically start at a minimum of $500 per year. Keep in mind that a lower cost policy may not offer the comprehensive coverage you may want. You can keep costs down by choosing a higher deductible.5) Municipal services.

Some municipalities charge fees for services like water or garbage removal. For example, homeowners in some larger urban centres pay $150 to $235 a year for curbside collection of garbage, recycling, and compost.6) Fuel or transit costs.

If you’ll be commuting a longer distance to work, consider whether you will face higher fuel or public transit costs or whether you’ll have to pay for parking.7) Monitored security.

If you opt for home protection, monitoring can cost anywhere from $20 to $40 or more per month, depending on the plan.8) Home maintenance.

Plan to cover all the occasional costs to keep your house in working order, such as changing furnace filters, carpet cleaning, clearing your eavestroughs, and touching up interior or exterior paint. You’ll find it easy to spend $30 or more a month on such home maintenance items and services.9) Property upkeep.

Consider outdoor areas that may need tending to, such as wooden decks, fences, gardens, and lawns. Even when you do the work yourself, budget at least a few hundred dollars seasonally for items like wood sealant, landscaping supplies, and plants.10) Repairs.

These are larger, less frequent expenses like replacing the roof, furnace, air-conditioning units, or appliances. Housing experts recommend setting aside 1% to 3% of the value of your house each year — a minimum $1,000 for every $100,000. While the ongoing costs of owning a home can add up to hundreds of dollars every month, we can help you plan ahead to manage these expenses and be comfortable with your financing.1) Have you explored all your options?

Once you receive your mortgage renewal statement, there’s nothing easier than simply signing on for another term. But while this may make sense in many cases, your family or financial situation may have changed over time. We can look for opportunities that could better meet your needs right now.2) Are you comfortable with your payments?

If you’ve been feeling financially strapped each month making your mortgage payments, this could be the time to reduce them to a more easily managed level. On the other hand, if you’re earning more, why not pay down your mortgage faster and save thousands of dollars in interest over time?3) Do you need cash flow for other things?

Your priorities may have shifted since you first bought your home, and your cash flow needs can shift too. Things like paying for a child’s university education, planning a career change, or a major purchase such as a vacation property may call for spending money on things other than your home. You may be able to refinance your mortgage to take this into account.4) Can you handle fluctuating rates?

Some homeowners are nervous about any hikes in interest rates, while others are comfortable to go with the flow. Rates are tough to predict. It’s best to base your decision on your personal situation, not what you read in the news, and tailor your mortgage renewal around your needs. We can help you decide whether to opt for fixed or variable rates — and we don’t want you to lose any sleep over your decision!5) Will you sell soon?

If you are likely to sell soon, consider a shorter-term mortgage or one that has flexible terms so you’re not penalized if you sell your house before the mortgage comes due.6) Are you thinking about a major renovation?

You know that projects such as a new kitchen or an addition can make your home more valuable. But the cost of having the work done can tie up a lot of money. Before you renew, look at all your financing options, which may include getting an additional line of credit or keeping your monthly mortgage payments low so you have money on hand to finance the renos.7) When do you want to be “mortgage-free”?

If you’re planning extended time away from work or perhaps an early retirement, it may make sense to pay down your mortgage sooner rather than later. While increasing your payments will raise your monthly costs now, you’ll ultimately save on interest in the long term and can prepare for that fabulous, mortgage-free lifestyle.8) Could you use your home equity to fulfill other goals?

Refinancing a mortgage can be one way to free up cash you need for other things, which could even include buying another property. Mortgage renewal time is an ideal occasion to review all your options.9) Have your insurance needs changed?

If your financial situation has changed since you first took out your mortgage, review whether you need the same level of insurance in place to cover mortgage obligations.10) Are you getting the best rates and terms?

In a competitive mortgage environment, your good credit history can make refinancing work to your advantage. We analyze mortgage markets daily to ensure you don’t miss any money-saving opportunities.Here are some Tips to be successful in finding the best Mortgage:

Tip # 1 – Get your house in order first!

Before you consider applying for a commercial mortgage or consider purchasing a commercial property – it’s important to ensure you have your finances in order. Make sure you have your Corporation’s financials up to date and preferably prepared by your accountant and current, most lenders like to see the past 2 to 3 years. Ensure personally, you have filed your income tax, have your current Notice of Assessment at hand and have a net worth statement available listing your current assets and liabilities. Your One Link Broker can provide you a net worth form to use. Some lenders may look to the individual’s personal situation to support the mortgage with a personal guarantee should there be concern with the property’s current and future cash flow or to help secure a more competitive interest rate or higher loan to value.If you have a complex corporate structure it’s beneficial to prepare a corporate Structure diagram, which will provide a clear picture of your business.

If you already own a commercial property make sure your operating statements for the property are up to date, your rent roll (tenancy schedule) is current, your leases are current and you have any reports on the property handy to be reviewed by your Mortgage Broker or lender.

Tip # 2 – Everything costs more with a commercial transaction!

It’s important that buyers be aware of the additional costs that are required to close a commercial deal. It’s best to remember that everything costs more with a Commercial Transaction and these additional costs are all the Borrower’s (purchaser’s) responsibility.

In addition to the legal, land transfer and closing costs you will also likely need the following:

A commercial appraisal of the property is usually mandatory and generally costs between $2,500-$3,000. A Phase I Environmental Report is required by a number of lenders and becoming more mandatory, and the cost generally runs between $1,800-$2,500. Some lenders also require a building condition report to determine the condition of the property and normally the cost is about the same as an Environmental report.

Plus Commercial Lenders charge a non-refundable application fee of between ¼% to ½% of the Mortgage amount or higher depending on the transaction size, which is paid to the lender upon acceptance of a conditional approval.

As Mortgage Brokers, we have some Commercial lenders that will pay us a fee and in some cases we need to charge our fee to the client for our service. We determine the best lending option for the client based on overall rate and costs and save our clients money by negotiating the best terms we can find them for their specific needs.

When determining your availability of funds for down payment and closing costs – it’s important to remember that you may also need to buy new machinery, equipment or technology for your new location; these costs are usually over looked.

Tip # 3 – Have a property strategy!

Lenders want to understand your business strategy or property and purpose for the Mortgage request. It’s important to be able to clearly state how the mortgage will help improve the value of the property, cash flow or increase your business’s income and situation.

Tip # 4 – Determine how much you can afford to pay!

Based on your current business or future net cash flow for the property you’re looking to purchase, determine how much you are comfortable paying monthly to help give your Broker and Lender an idea of what range you should be in for total mortgage amount and the length of amortization you can support.

Tip # 5 – Determine what kind of building you need!

When you’re ready to start looking for a property to purchase it’s important to determine what’s important for your business operations. What’s working in your current space and what’s not? Determine from your current situation what will work best for your new Building. Location, where do you need to be located to function and optimize your earning potential? Square footage, do you need more or less space? Building type, two storey, office with warehouse space etc.? Do you want a multi-tenant building with other tenants to help support your Mortgage and help with cash flow or do you not want to manage other tenants? Are you planning or will you need to renovate the property after you take possession to customize the space for your specific needs? Make sure to find a reputable contractor to provide you an estimate for the cost to complete the work ahead of time so you know how much money you will need for your Mortgage, down payment and closing costs.

Tip # 6 – Get expert tax advice!

Make sure to discuss your potential purchase with your Accountant to determine the best tax strategy for your personal situation. Tax implications can be very complex in real estate transactions.

Tip # 7 –Hire a good and reputable Commercial Realtor!!

Now that you’re ready to buy, the first Step is to find yourself a good, reputable and experienced Commercial Realtor. A Commercial Realtor has access to properties that have already been listed and possibly others not yet on the market. In addition, your Commercial Realtor has access to all the financial information on the property that is required for a Commercial Mortgage Specialist to get a financing approval including property taxes, historical operating expenses on the property, historical and current revenues, data on existing tenants and leases, recent renovations completed on the property etc.

Tip # 8 – Hire a Commercial Real Estate Lawyer!!

Make sure that you select a lawyer who has a background handling Commercial Real Estate transactions so that you have the right representation. Although Commercial Real Estate Lawyers can be more expensive, it’s important to make sure you are legally protected, as this will likely be one of the largest purchases of your life.

Tip # 9 – Use an experienced Commercial Mortgage Professional!!

The Terms of a Commercial Mortgage are determined quite differently then a residential mortgage. The interest rate, loan to value and terms of the mortgage are determined by lender based on the type of property, the location of the property, the condition of the property, the cash flow of the property and the mortgage payment it can support, the strength of the applicant and company applying for the mortgage and whether the applicant will provide a personal guarantee. The overall situation is taken into consideration by the lender and the terms are determined based on the overall risk and strength of the file.

Your Mortgage Professional is an expert at putting together a comprehensive package to present on your behalf to potential lenders and will take the pressure of negotiating the terms of your mortgage from you. A good commercial mortgage professional should be able to reduce your interest rate and negotiate the most favorable terms for you.

Our One Link Commercial Mortgage Team consists of Clarke Culbertson, Randy Cullen, Barrie Nelson and Meredith Kaminsky with over 90 years of collective business financing experience in the Commercial lending industry. With our expert knowledge, we work on your behalf – and because we’re paid a finder’s fee for completing the transaction we have a vested interest in obtaining a financing approval. We will negotiate the best deal for our clients, including interest rate, security, terms and conditions."WE WORK FOR YOU"

We are a very experienced commercial team that will sell your business financing proposal to prospective lenders.

We have business relationships with many institutional and private lenders that can provide interim or permanent financing for a variety of projects including acquisition, refinancing, development, rehabilitation and lease options.

We also provide a consulting service to help you determine the viability of your project prior to purchase, sale, financing or development.

|

-

USEFUL LINKS

Associations

- - Mortgage Professionals Canada

- - Manitoba Home Builders Association

- - Winnipeg Construction Association

- - Better Business Bureau - Manitoba

Home Decorating

- - About.com Interior Decorating Site

- - Debbie Travis' Painted House

- - Martha Stewart Home Decorating

- - HGTV: Decorating, Remodeling and More

- - Debbie Travis' Facelift

- - Do Your Own Home Design

- - Divine Design: Designer Rooms, HGTV

- - Professional Interior Designers Institute of Manitoba

- - Home Renovations

Home Security

- - Winnipeg Police - Home Audit Checklist

House Building

- - House Plans - Thousands!

- - Everitt Design

If you're moving…

- - Claiming your Moving Expenses

- - Traffix - The Transportation People

- - United Van Lines

- - U-Haul

- - Two Small Men With Big Hearts Moving Company

- - AMJ Campbell Van Lines

- - Atlas Van Lines

- - Allied Van Lines

- - Recycling Depots

Industry Links

- - VERICO - Canada's Trusted Mortgage Brokers

- - CMHC Housing Stats

- - Equifax Free Credit Report

- - TransUnion Free Credit Report

Mortgage Insurers

- - CMHC - Canada Mortgage & Housing Corporation

- - Genworth Financial Canada - Mortgage Insurance

- - Canada Guaranty - Mortgage Insurance

Property Taxes

- - About City of Winnipeg Property Tax Installment Payment Plan

- - TIPP Application Form

- - Winnipeg Assessment - What is the assessed value of your home?

Real Estate Appraisers

- - Find a Real Estate Appraiser

Real Estate Links

- - What's My House Worth?

- - Multiple Listing Service - Find a home online!

-

CHECK YOUR CREDIT

-

HELPFUL FORMS

- - Download file Client Consent to Obtain Credit Report

- - Download file Application form to City of Winnipeg TIPPs program (Tax Installment Payment Plan)

- - Download file Mortgage Application Form (to be printed, filled in and faxed to us)

- - Download file Gift Letter - Use this form if your down payment is being gifted to you

- - Download file Homebuyers Plan for Using RRSPs as Down Payment

MORTGAGE TIPS

Our goal is to help you clearly understand the mortgage process. We have put together a collection of helpful TIPS to assist you.

Learn MoreHELPFUL FORMS

You will find a selection of commonly used documents and forms that you can download to assist you with the mortgage process.

Learn MoreVIDEOS

Browse the variety of short videos to help you better understand the mortgage industry.

Learn More